The Dow Jones found support around 12300 and broke the short-term resistance around 12450 to indicate the resumption of the overall uptrend.

Tuesday, May 31, 2011

Wednesday, May 11, 2011

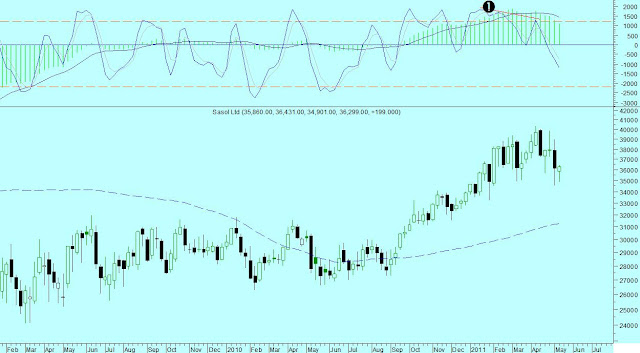

DJ Global Index; Sasol Weekly & Daily; Brent Oil in Rand terms - 11 May 2011

(Click on image for larger view)

The Dow Jones Global Index pulled back to confirm horizontal and Fibonacci support and the oscillator is in buying territory. This is a buying opportunity in an ongoing bull market.

The sideways consolidation on Sasol looks like a "head-and-shoulders" reversal pattern, but is it?

Firstly, we must remember that a pattern is only completed when and if, the neckline breaks. Before that it is a sideways consolidation, with no strong directional meaning. The only indication that such a sideways consolidation might be completed to form a "head-and-shoulder" reversal pattern is if we see a negative divergence on a higher timescale. In this case we should see a negative divergence on the weekly MACD of RSI to confirm the likelihood of a break to the downside.

(Click on image for larger view)

Line -1- shows a divergence over the weekly Stochastic oscillator, but there is no divergence on the MACD. This in my book is a sideways consolidation in a longer-term uptrend. The price can drift sideways for a few weeks untill the stochastic reaches oversold levels.

(Click on image for larger view)

Sasol is a proxy for the the oil price in Rand. This is the picture that drives the price of Sasol. The MACD (green histogram) made a new high along with the price, telling us that the longer-term trend is positive. The weekly stochastic showed a negative divergence; warning of a shorter term correction which we are currently experiencing. The price can drift sideways or can even come down further but any pullback will be a buying opportunity in a longer-term bull market.

(Click on image for larger view)

If we look at the daily graph of Sasol, we see the price is confirming horizontal as well as strong Fibonacci support (green line). A stop for long positions will be just under 350. That will be a close under 345.

Tuesday, May 10, 2011

Brent Crude - 10 May 2011

Lower oil prices? Not likely!

Some commentators are convinced that the crash in the commodity market last week was the start of a longer-term decline in the price of oil and other commodities. What is the price movement (the "track") telling us?

(Click on image for larger view)

The "track" left by this animal tells us unmistakeably that it is heading north! The price came back to find rising support, Fibonacci support and the moving average between 105 and 110. While there are always many fundamental reasons why the price should decline or rise, the price movement does not lie. As long as support holds, the trend is positive.

The temporary correction in the US Dollar drove all commodities lower. The longer term trend for the Dollar is still weaker.

Monday, May 9, 2011

Copper weekly - 09 May 2011

How is Dr. Copper doing? Analysts view the price movement of copper as an indication of growth in the world. Copper is in demand at industrial and residential building projects and for production at factories. If the price of copper is in decline, it means that demand is lower because of lower production and building from the end users of copper. In the end it is an indication of the spending power of the global consumer.

Well what is it saying?

A textbook "rising wedge" pattern (red dotted lines) warned us of the crash of 2008. The market recovered to break out to a new high above line -1-. The price pulled back last week to test support at line -1-. A negative divergence on the short-term oscillator (Stochastic) warned us of the impending correction. However, there is no negative divergence on the longer term oscillator (MACD Histogram). This tells us that the price of copper is still in a longer-term uptrend. The stochastic indicator is in oversold territory on the weekly scale. As such it is giving a buying signal in a longer-term bull market.

Dr. Copper had a light sneeze but generally, he is in good health!

Tuesday, May 3, 2011

Dow Jones Futures - 03 May 2011

We trust that our regular readers enjoyed the Easter weekend, and are refreshed to face the trading opportunities as they present themselves.

While we stick to our longer-term positions in selected shares, we also manage shorter-term opportunities for those clients who wish to trade more actively in search of greater yield.

The International market had an excellent rally since middle March. It is time for a correction of this rally since the market is overbought on a daily and weekly scale. A pullback to 12400 will present another entry point in the rising trend. We use the Dow Jones Industrial Average as an indication of the health of the global market. By co-ordinating our entry points on selected JSE-listed stocks with pullbacks on the Dow, we increase our return on equity.

While we stick to our longer-term positions in selected shares, we also manage shorter-term opportunities for those clients who wish to trade more actively in search of greater yield.

The International market had an excellent rally since middle March. It is time for a correction of this rally since the market is overbought on a daily and weekly scale. A pullback to 12400 will present another entry point in the rising trend. We use the Dow Jones Industrial Average as an indication of the health of the global market. By co-ordinating our entry points on selected JSE-listed stocks with pullbacks on the Dow, we increase our return on equity.

Such a pullback will give us a good "risk/reward" entry and an opportunity to add to current positions. Risk in this case is defined as the difference between the entry point and the stop loss level.

Friday, April 8, 2011

Absa Weekly - 08 April 2011

In this example we look at the value of the oscillator, first as a warning of a correction or consolidation to come, and secondly as confirmation of a breakout in price. The RSI is a "momentum" indicator as it compares the current price to that of a certain time-period ago.

It tells whether the price rises slowly and sustainably, or too fast. A divergence between price and oscillator is one of the very few indications that have predictive value. The other oscillators and moving averages follow the price but a divergence in the RSI actually leads the price.

Let's look at the example in the form of Absa Bank.

During 1998 the price made a new high around R50. The RSI at that stage did not make a new high along with the price, this setup is known as a divergence between RSI and price and warns of a correction or consolidation in price.

The price did make the subsequent 50% drop to R25, but what is more important in this case is the long-term consolidation or sideways movement that followed. The price moved sideways for 6 years (rectangle -2-) before the break of line -1-, at arrow -5-, signalled the start of a new surge in momentum and a rising trend.

We see a similar setup within rectangle -4-, where the resistance line -3- over the momentum indicator acts to suppress a surge in price. A break of line -3- will signal the start of a new trend and surge in momentum, similar to the 275% rise in price between 2004 and 2007. In the meanwhile there are better investment opportunities elsewhere on the JSE. We monitor line -3- as a timing indicator to move into the banking sector.

By analyzing investment opportunities in this way we apply capital where the potential for appreciation is greatest.

If you are willing to listen, the RSI can tell you more stuff, more accurately than a heap of fundamental analysts ever can.

Thursday, April 7, 2011

JSE Mining - 07 April 2011

So far today we see the start of a potential correction in mining shares. The Relative Strength Indicator in the top window finds resistance at line -1- over the negative divergence. This implies that the mining sector is still in consolidation mode since November 2010.

We can expect the end of this sideways action and the start of a new trend when line -1- eventually breaks. The index might pull back to support at 3700 (the green line as a Fibonacci support level).

We view such a pullback as a buying opportunity for mining shares.

Monday, April 4, 2011

Datatec - 04 April 2011

Datatec is our favourite company in the IT sector. The share price broke out of the year-long sideways consolidation to start a new trend.

Thursday, March 31, 2011

Shoprite Weekly; Exxaro - 31 March 2011

The resistance line over the RSI negative divergence puts pressure on the momentum in the price action. The divergence warned us of the correction/sideways action to come. The sideways action took us to the trendline, which was confirmed as support.

We expect resistance on the price to break along with the break of resistance over the RSI to signal the start of a new trend with strong momentum.

Exxaro Resources broke out of the consolidation to make a new all-time high. It is short-term overbought so a pullback to 156 is buyable.

Tuesday, March 29, 2011

Emerging Markets Index; Richemont - 29 March 2011

This index reached the target of the "head-and-shoulders" reversal pattern shown in the red circle here. We had a good (13%) correction from resistance. The price confirmed support last week and we see a buy signal from the Stochastic in the top window.

The next target is the all time high at 450. This implicates an increase of 33% for emerging markets.

The price moved sideways to meet the rising support line. There is horizontal support at 37.70. The MACD Histogram (green, top window) is above the zero line and came back from overbought levels. The stochastic in the upper window is giving a "buy signal in a bull market". The volume in the lower window is above the moving average, indicating buying pressure.

This is a bullish setup and investors can view is as a buying opportunity. Speculators should implement, and follow their money managent and stoploss principals

JSE General Financial; JSE Industrials; Imperial Holdings - 25 March 2011

This index has basically been trading sideways since August 2008. It came back to test support on the weekly moving average and the action of the last week confirmed this support. We view this setup as a low-risk buying opportunity for selected financials.

After a good (15%) correction, the index confirmed support on the weekly moving average. The weekly stochastic is giving a buy signal. Any small pullback next week is viewed as a buying opportunity in selected industrials.

Imperial is one of the stronger performers in the industrial sector. It came back (20%) to test and confirm support from buyers at 10.50. This is a confluance of support. We see horizontal, rising and fibonacci support near the weekly moving average. The weekly candle is a "bullish engulfing" candle that acts as confirmation of longer-term support as well as a buy signal.

Thursday, March 17, 2011

Remgro; US$ Weekly - 17 March 2011

Remgro is trading at the rising support line around 104. This is also a strong Fib level (green line). The oscillators are grouping in the top window, indicating a timing signal for a turning point. Wait for a bullish reversal before buying. A tight stop will be a close below 103 and if support breaks, the target to the downside is 90.

Over the past 3 weeks we have witnessed a significant event on the currencies. We are all aware that currencies are always volatile and that movements are unpredictable most of the time. Sometimes however, we see a movement in price that has more significance than the normal week-to-week or even monthly movements.

Such an event signals the start of a new, longer term trend. The dollar index broke the support line -1-, that began in 2008. As such, it broke out of a 3 year consolidation during which the dollar strengthened and weakened in a triangle formation against a basket of currencies. The recent break of the trend line, signals the start of a new weakening trend for the Dollar.

The graph shows that the index is consolidating below the trend line, and failed to break above what is now resistance at 77.

The longer the index fails to break above 77, the greater the odds of a major weakening in the Dollar. We can expect the Dollar to weaken to 70 on the index which implies a weakening of 9%.

The longer the index fails to break above 77, the greater the odds of a major weakening in the Dollar. We can expect the Dollar to weaken to 70 on the index which implies a weakening of 9%.

That will only be the beginning of a much larger trend for a weakening Dollar as we see signs that there is a possibility for the dollar to weaken by 40% over the next decade.

This scenario will be driven by the yield differential between the basket of currencies. The negative real interest rate scenario in America will be the fundamental driver of this trend. When interest rates in America are below the rate of inflation, it means that money is for free and worth less against currencies with positive real interest rates.

The direction of the share market and commodity market depends on the value of the dollar. Think about the implication for inflation in South Africa and the rest of the world if the reserve currency (USDollar) is devalued by 40%. For starters, it implies that without any demand/supply shocks, the price of wheat, maize, oil etc. will increase by 40% in terms of the Dollar. Let's hope that the strengthening of the Rand will protect us against such a rise in the cost of basic necessities. We have seen the riots all over the world that stemmed from high food prices. High food prices and high unemployment is an explosive mixture in any country. It is the mandate of our Reserve bank to fight inflation. As long as that remains their mandate, the Rand should strengthen. The risk here is that fraud, overspending on social grants, poor service delivery and incompetence in government structures may weigh heavier on the Rand than the pro's of having one of the most competent Reserve banks in the world.

Wednesday, February 16, 2011

JSE General Retail - 16 February 2011

In the bottoom window we see the JSE-General Retail index bouncing off Fibonacci support on the weekly graph. The index confirms support this week. In the top wiindow we look at the ratio of the Retail index to the average of the market (JSE Alsi40). The rising trend of the black line indicates that the retail sector outperforms the Alsi40.

The ratio pulled back over the last few months to come and test the moving average. We expect retail shares to resume their outperformance from here on forward.

Wednesday, February 2, 2011

Murray & Roberts; Dow Jones - 02 February 2011

Things do not look good for Murries. The crucial, long term support level at 37.50 broke with a bang. The price is oversold now but any retracement to 37.50 will be met with lots of selling pressure. We don't have any Murries in our portfolios and we won't be interested in buying any before at least a 50% drop from current levels. The first major technical support level is around 15.

What does it say about a government if companies who get a tender to build infrastructure, do not get paid for work done? When will they get paid? The answer to this question will determine the value of the shares.

The Dow Jones is still above short term support. After the bearish reversal candle of last week we should be on edge and monitor stops closely. The stop is at 11700 and we believe that a break of short term support can lead to a selloff to around 11000. That implies a drop of 7%, which is ok for long-term investors to bite the bullet, but there is no way to have certainty that the decline will stop at 11000. That support may also break, so we feel that the most prudent action will be to take our stops when signalled by the market, and buy back the positions when support is confirmed.

That is the only way in which we can protect capital and exploit opportunities in an uncertain environment. This method has been proven time and again to add value over a buy-and-hold strategy. (Those in doubt may enjoy reading "Trend Following: by Michael Covel)

Tuesday, February 1, 2011

USD/ZAR - 01 February 2011

The Rand/USD went all the way to test major resistance at 7.20. The longer term trend is still one of a strengthening Rand, so we can expect the pair to target 6.50 over the next few months. This scenario is the dominant one for as long as 7.20 remains intact as resistance.

The weakening of the rand is ascribed to the accumulation of reserves by the SA Reserve bank, as well as foreign investors taking profit and balancing their portfolios. The fact that real interest rates in America will stay negative while in South Africa it will be positive should support rand strength for years to come. It simply means that money in SA will continue to be more expensive than money in America, meaning you could get more dollars for your rand .

Monday, January 31, 2011

Dow Jones Industrial Average Index - 31 January 2011

The Dow Jones gave us a warning signal last week. The black candle in the red circle shows selling pressure at previous resistance. This is a warning that we may see more selling pressure coming into the market as participants take profits at first, and protect capital as the decline progresses. We are monitoring the situation closely.

Thursday, January 27, 2011

JSE Banking Index; JSE Financial Index; Capitec - 27 January 2011

In a previous post we said, "It is not yet time to buy banks." The action of the past 2 weeks confirm this view. The banking index did confirm overhead resistance last week and is pulling back to look for support.

If horizontal support at 38 500 breaks, the index may fall all the way to Fibonacci support at 34 500. This implies a possible 15% decline from current levels. We won't be buying banks just yet.

The JSE Financial Index (which includes the banking index) is giving clear warning signs to investors. Within the black ellipse we see the index trading in a "rising wedge" pattern. This normally is a reliable reversal pattern.

With this in mind, we won't be buying financial shares and will be keeping a close eye on the decision making levels of current holdings. If this index breaks to the downside of the pattern, we expect a 15% drop to 18 500.

Capitec must have been the best performing share on the JSE over the last year. Currently we are witnessing a rare pullback. A potential target for such a correction could be horizontal support at 140. The "risk" involved in buying a share, can be summerized as the difference between the current share price and it's 89-week moving average price. Here we see that moving average at 100. We see Fibonacci support at 120, this is the 38% retracement of the whole upwards leg since April 2009.

One thing is certain, the weekly support level has broken, to signal the end of the bull run. Now we will have to wait and see if the correction does materialize or whether we will only see a sideways consolidation. It is too early to buy and not to late to take profit.

Tuesday, January 25, 2011

S&P500; JSE Share TOP40 - 24 January 2011

Despite the signs that a correction could start any day now, the index is still holding above support. A break below 1275 will signal the start of a correction of between 10 to 15%.

This local index confirmed support on Friday during the afternoon, after trading negative during the morning. The index is still trading within the "rising wedge" pattern. In the majority of cases this is a reversal pattern, so traders will have to monitor their stops closely. If support breaks, we might see a correction of about 15% in this index.

Tuesday, January 18, 2011

JSE Food & Drug Retailers - 18 January 2011

The JSE Food & Drug Retailers sector pulled back over the last few months. The index is now back at long-term support while the oscillator is giving a buy signal in oversold territory. The price action of the last week confirms this rising support trend line.

This is a typical buying opportunity in a bull market.

Monday, January 17, 2011

JSE Overall Index - 17 January 2011

It is time to sit up straight and take notice of this situation on the JSE Overall Index. The index is right at the level where we saw the reversal during 2008 and the market is currently overbought on the monthly, weekly and daily timeframes so we could be in for a major correction here. We will have to see what the coming week holds in store. It could be that we get some follow through after the strong action of last week and then, later in the week, get the reversal to confirm resistance.

Explanation:

Support: When buyers are willing to pay a certain price, and the sellers are not willing to sell below that price, we call it a support level; ie. buyers supporting the market. When we see rising support levels it indicates a bull market.

Resistance: In this case it has nothing to do with the French fighters during the 2nd World War. The price level at which sellers are in control of the market and the level at which the buyers are not willing to pay more, is known as resistance. When we see consecutive lower resistance levels it indicates a bear market.

By studying support and resistance the analyst can determine the current trend in a certain timeframe. The aim is to own shares in a bull market and to be in cash or protect capital during a bear market. By doing so the investor can add value to his overall, long-term returns, while being able to sleep at night.

Thursday, January 13, 2011

JSE Banks Index - 13 January 2011

We have to keep an eye on this situation on the JSE Bank Index. What we see here is the index from the start of the crash in 2007. Note how the index has found resistance, at the previous high, since April 2010. The index has been trading in a "consolidation pattern", that takes the form of a "flat top triangle" for months. Flat top triangles usually break out to the upside and it is a bullish pattern.

If the banking index can break above this long term resistance it implies that the circuimstances for banks have changed for the better and that the negative effects of the recession is behind us. The banks are working through their bad debts and the cost cutting of the past year will improve profitability. South African banks withstood the financial turmoil of recent years and will have room to grow, while their international competition is still flooded with worthless assets.

We will have to wait and see if the index can break resistance before we buy the stronger banks. At the moment the index is overbought on the weekly scale. That means that resisistance might last and the index might pull back to support. It is not yet time to be buying.

Wednesday, January 12, 2011

USD / ZAR; ASX All Ords; Share Holder Weighted Top40 Index - 12 January 2011

The current action on the USD/ZAR confirms the strengthening trend of the Rand. The long term trend is intact. It will take a break above 6.90 to change this view.

The ASX confirmed support today. We will have to wait and see if this index can break above previous resistance at 4880. The ASX usually gives an indication of what to expect locally.

Here we are seeing warning signs of a larger correction to come. We now have a "compound divergence" on the RSI, while the index is trading in a possible "rising wedge" pattern. This combination is a reliable warning that a correction is imminent.

Shorter term traders should consider pulling their stops to under the last support level. We expect it to be a correction in a longer term bull market, so it will be a buying opportunity.

Thursday, January 6, 2011

AUS$ / USD; CBOT Wheat; SAFEX Wheat - 06 January 2011

The Dollar strength of the last few days is temporary. Here we see the AUS$ pull back to test the longer term rising trend line. The strengthening trend for the AUS$ and the Rand is still intact.

The Rand might retrace to 6.80 against the USD before targeting 6.50 again.

After breaking resistance at 750 and consolidating above that level, the price is set for the next resistance level at 950.

The local wheat price is busy completing a huge "bottom formation" that started in November 2008. The price must break above the current Fibonacci resistance at 2900 (green line) to get going with an eventual target of 3800. This target may only be reached towards the end of 2011.

Our feeling at the moment is that the opportunity in the wheat market should be well exploited this year for the adverse situation in the Ukrain and Queensland; and the wheather problems in the USA won't last forever. We might have to fix the price for 2012 forward towards the end of 2011. We will keep you posted.

Remember, even the best analysis is never a certainty. Always limit your exposure and protect your capital.

Tuesday, January 4, 2011

Clicks - 04 January 2011

During the first week of November, the negative divergence between ossilator and price warned us of the coming correction. We believe this correction is nearing it's end as the price is at longterm rising support.

A confirmation of support and a subsequent break of resistance at 44 will serve as a buy signal for us.

Subscribe to:

Comments (Atom)